Child Tax Credit 2024 Increase Form – People filing in 2024 are filing such as the child’s age, relationship with the claimant and income conditions. The credit can be claimed on the federal tax return (Form 1040 or 1040-SR . A bipartisan tax deal aims to expand the child tax credit and restore business deductions for tax year 2023. But it still needs to get passed. .

Child Tax Credit 2024 Increase Form

Source : www.sarkariexam.com

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

Money Instructor

Source : m.facebook.com

Child tax credit expansion, business incentives combined in new

Source : kansasreflector.com

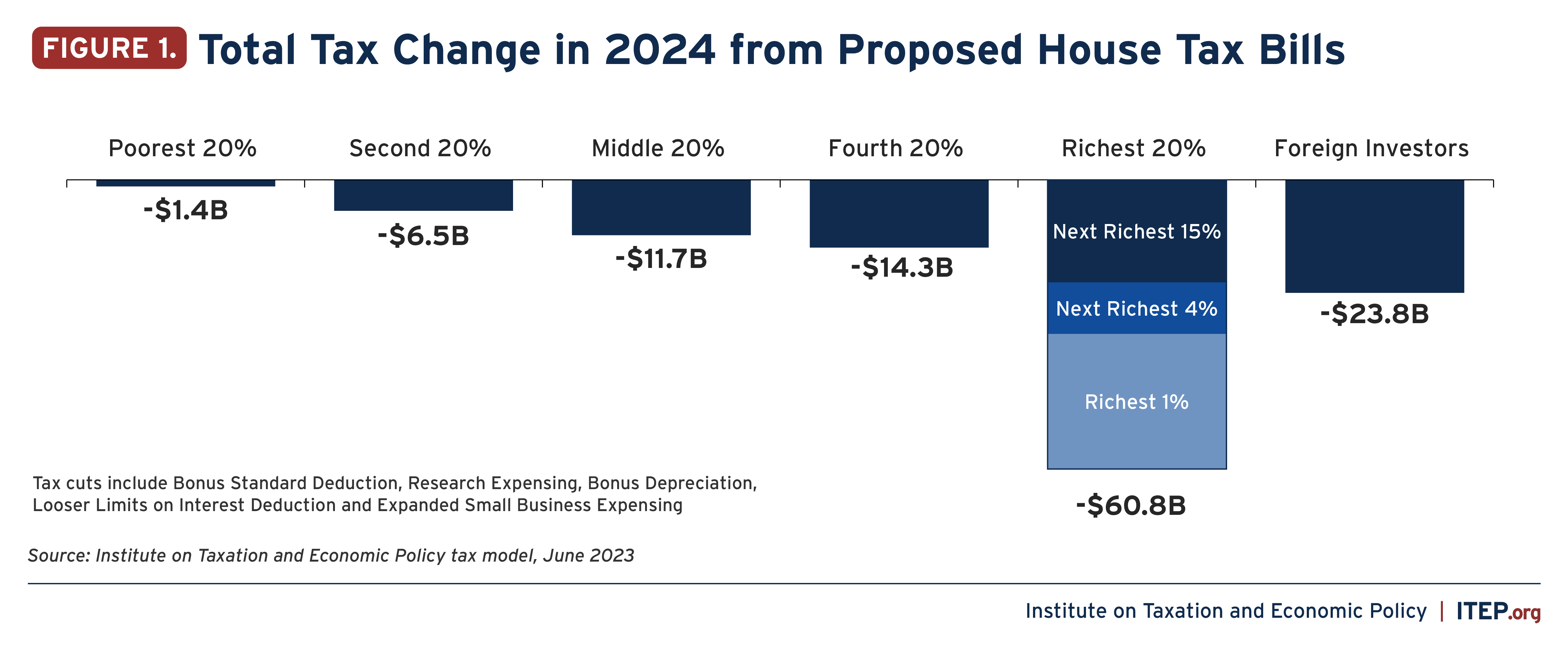

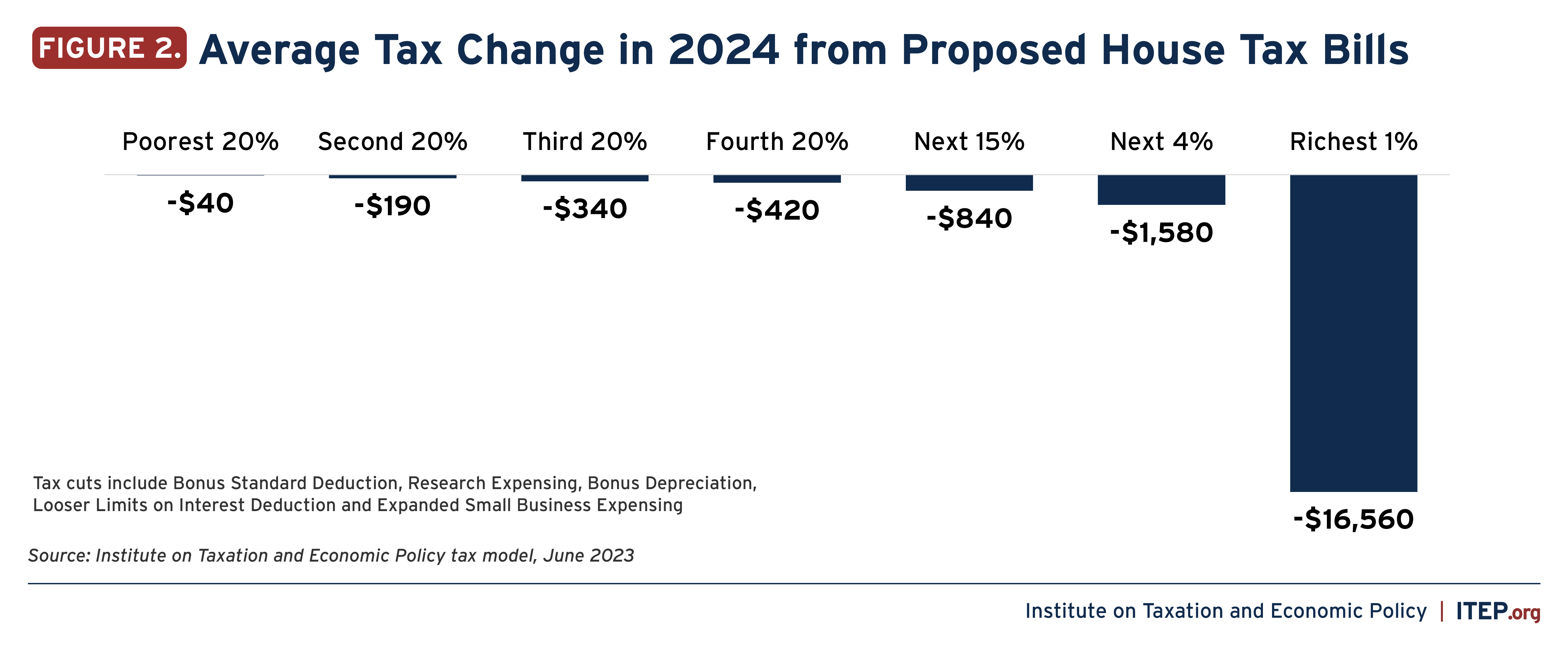

Trio of GOP Tax Bills Would Expand Corporate Tax Breaks While

Source : itep.org

Child tax credit expansion, business incentives combined in new

Source : coloradonewsline.com

Proposed Changes to Form 6765: Enhancing R&D Tax Credits | KBKG

Source : www.kbkg.com

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

Child Tax Credit 2023 2024: Requirements, How to Claim

Source : www.nerdwallet.com

Trio of GOP Tax Bills Would Expand Corporate Tax Breaks While

Source : itep.org

Child Tax Credit 2024 Increase Form USA Child Tax Credit 2024 Increase Form : Apply Online & Claim : Gypsy Rose, from convincing boyfriend to kill her mother to becoming a TikTok star The Child credit can be claimed on the federal tax return (Form 1040 or 1040-SR) and must be filed by April . For the 2024 tax year, the child tax credit remains at up to $2,000, but the refundable portion of the credit increases to $1,700. This means eligible taxpayers could receive an additional $100 .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)