Child Tax Credit 2024 Irs Portal – I f you have any children under the age of 17, including any born during 2023, you could be eligible for the child tax credit. If you’re eligible, it could reduce how much you owe . What to expect for 2024 count as qualifying children. According to the IRS, “all of the following must apply to qualify a child for the child tax credit: The child must be under age 17 .

Child Tax Credit 2024 Irs Portal

Source : pluginamerica.org

IRS Child Tax Credit 2024: Credit Amount, Payment Schedule, Tax Return

Source : kvguruji.com

USA Child Tax Credit 2024 Increase From $1600 To $2000? Apply

Source : cwccareers.in

CHILD TAX CREDIT ONLINE FILING PORTAL IS OPEN AGAIN: | NSTP

Source : www.nstp.org

Here Are the 2024 Amounts for Three Family Tax Credits CPA

Source : www.cpapracticeadvisor.com

IRS opens non filer portal for child tax credit registration

Source : www.mynews13.com

USA Child Tax Credit 2024 Increase From $1600 To $2000? Apply

Source : cwccareers.in

Vertex Business Solutions | Brunswick GA

Source : m.facebook.com

$7,500 at stake: Dealers face challenges in new fed program for EV

Source : www.detroitnews.com

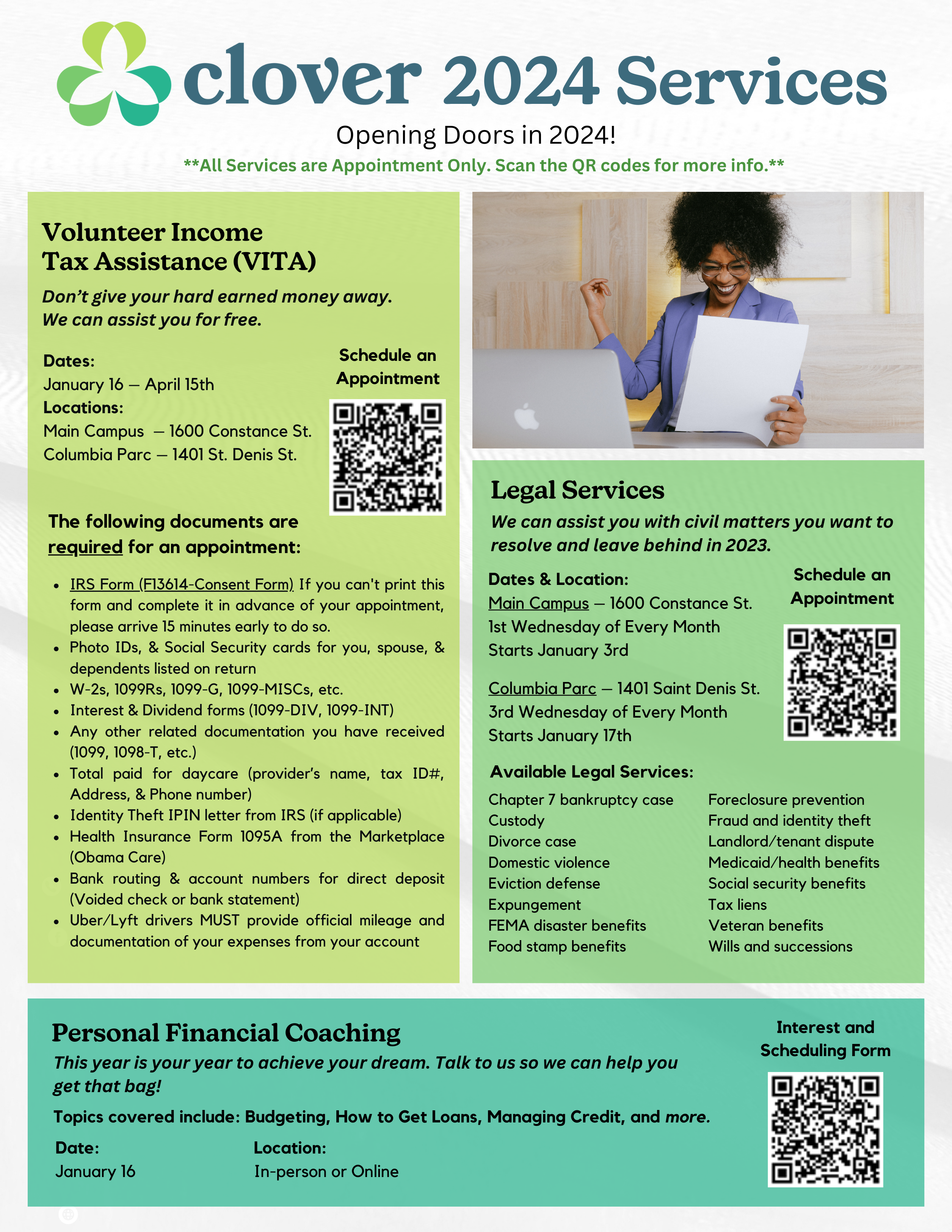

Parent Portal | Clover New Orleans

Source : clovernola.org

Child Tax Credit 2024 Irs Portal 2024 Federal EV Tax Credit Information & FAQs Plug In America: Find out if you’re eligible for the child tax credit in 2024 and learn how to claim your entitlement. With tax season drawing near, families with children under 17 need to explore the potential . Instead, taxpayers will only get a 1099-K form if they received over $20,000 and had more than 200 transactions in 2023 through these apps. They IRS says this delay is to help taxpayers adjust and .